Home prices 6% higher, sales down 8% from a year ago, says C.A.R

07-27-2018

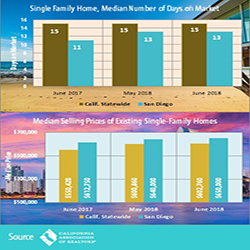

The median price of an existing single-family home in San Diego County hit another new high, reaching $650,000 in June 2018, compared to $602,760 statewide, according to the California Association of REALTORS® (C.A.R.) in its June home sales and price report. June’s median price in San Diego was up 1.6 percent from May and 6.1 percent from June 2017.

C.A.R. also said San Diego County’s home sales in June 2018 were up 2.9 percent from May and down 8.6 percent from June 2017. However, other areas of the state experienced an even larger decline in June in year-over-year comparisons. Los Angeles dropped 10.8 percent, San Bernardino sales fell 10.2 percent and Riverside County sales plummeted 16.9 percent from a year ago. Orange County fell 9.9 percent while Ventura County experienced the largest sales decline in Southern California with an 18 percent year-over-year drop. The Southern California region suffered the largest home sales drop, falling 11.7 percent from May, according to the C.A.R.

“Every county within the (Southern California) region posted declines with all but Orange and San Diego counties experiencing a year-over-year, double-digit pullback,” said the C.A.R. report. “Even the Inland Empire, which had been buoyed by San Bernardino County for the past several months, experienced significant declines.”

“California’s housing market underperformed again, despite an increase in active listings for the third straight month,” said C.A.R. President Steve White. “The lackluster spring homebuying season could be a sign of waning buyer interest as endlessly rising home prices and buyer fatigue adversely affected pent-up demand.”

The statewide median home price of $602,760 in June marked a 0.3 percent increase from May and an 8.5 percent jump from the revised $555,420 figure in June 2017. June marked the fifth consecutive month that prices increased by more than 8 percent annually, indicating that price appreciation remains robust and is not showing any signs of leveling off, according to C.A.R. The median price is now 1.4 percent higher than the pre-recession peak and has been growing on a year-over-year basis for more than six years, said C.A.R.

Closed escrow sales of existing, single-family detached homes in California totalled a seasonally adjusted annualized rate of 410,800 units in June, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2018 if sales maintained the June pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales. June’s sales figure was up 0.4 percent from the revised 409,270 level in May and down 7.3 percent compared with home sales in June 2017 of 443,120. The year-over-year sales decline was the largest in nearly four years.

“Although home prices increased year-over-year in virtually every region of the state in June, at the same time, nearly every county experienced a significant contraction in home sales from a year ago,” said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. “With the year-to-date sales tally now in negative territory, the back-to-back sales declines could be an early sign that the market is transitioning, especially since further rate increases are expected to hamper homebuyers’ affordability and put a cap on how much they are willing to pay for their new home.”

The median number of days it took to sell a California single-family home remained low at 15 days in June 2018, unchanged from May 2018 and June 2017. Meanwhile, in San Diego County, the median number of days a home remained unsold on the market was 13 days in June 2018, compared to 13 days in May 2018 and 11 days in June 2017.

Other key points from C.A.R.’s June 2018 resale housing report included:

- By price segments, sales in every price category under $1 million contracted, but lower-priced homes registered the largest sales decline as homes priced below $300,000 fell 23.8 percent from a year ago. At the other end of the spectrum, sales of homes priced $1 million and above increased 7.2 percent from June 2017. The very top end of the market, in particular, continues to post double-digits gains with homes priced over $2 million rising year-over-year by more than 13 percent in June.

- Statewide active listings improved for the third consecutive month, increasing 8.1 percent from the previous year. The year-over-year increase was slightly below that of last month, which was the largest since January 2015, when active listings jumped 11.0 percent.

- As sales declined from a year ago, the unsold inventory index, which is a ratio of inventory over sales, increased on a year-over-year basis as well. The statewide unsold inventory index edged up to 3.0 months in June from 2.7 months in June 2017. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate.

- The 30-year, fixed-mortgage interest rates averaged 4.57 percent in June, down from 4.59 percent in May and up from 3.90 percent in June 2017, according to Freddie Mac. The five-year, adjustable mortgage interest rate, however, edged higher in June to an average of 3.82 percent from 3.79 percent in May and from 3.14 percent in June 2017.

In other recent real estate and economic news, according to news reports:

- According to CoreLogic, San Diego County’s median home price hit another record in June, reaching $575,000, while sales hit their lowest point in years. The previous record was $570,000 in May, said CoreLogic. Home prices have been steadily breaking records all year, with prices increasing 5.5 percent in a year as of June. A lack of homes for sale has reduced sales significantly while pushing prices up. There were 3,927 home sales in June, down 9.4 percent from the same time last year. That’s the lowest in four years for June in San Diego County. “Affordability and inventory constraints are likely the main culprits in last month’s sales,” said CoreLogic data analyst Andrew LePage.

- A study of housing conditions in the San Diego region predicts a “perpetual” imbalance between supply and demand that will cause companies to lose talented employees. The most significant finding from the study by London Moeder Advisors is that the region has built little more than 20,000 of an estimated 86,000 new units needed between 2012 and 2020. “There will be a continuation of high housing prices and rent increases fostered by an inability to bring to market sufficient new housing units,” the study predicted. “Without appropriate public policy action, demand will perpetually outpace supply.” The study, prepared for the San Diego Regional Chamber of Commerce, also said the housing crisis has led to longer commutes and greater congestion, resulting in employee and employer dissatisfaction, and threatening economic growth.

- The real estate market and regulations that drive up the cost of housing are certain to be part of the California gubernatorial race between John Cox and Gavin Newsom. Cox recently appeared at a Studio City home that was used for exterior shots for “The Brady Bunch,” a 1969-1974 TV show. The three-bedroom, three-bathroom home was listed for $1.885 million. The house was last sold in 1973 for $61,000. “Mike and Carol Brady could not afford this house today,” said Cox, referring to the fictional architect and housewife raising six children in the TV series. “A family to afford this house would have to make over $300,000 a year because the annual cost of owning this house is over $100,000 a year. That isn’t going to work in California.”

- San Diego is the country’s fifth best big city to inhabit, according to a study released by WalletHub. The personal finance company used 56 metrics to compile its “2018 Best Big Cities to Live In” list. The country’s 62 largest cities were evaluated. Data ranges widely and includes public school system quality, job opportunities and median annual property taxes, among other things. Seattle, Virginia Beach, Austin and San Francisco, in that order, claimed the top four spots ahead of San Diego. Rounding out the top 10 were Honolulu, Portland, San Jose, Colorado Springs and New York City. Of the 62 cities evaluated, WalletHub ranked San Diego’s quality of live and education-and-health systems fourth; its safety 10th; economy 15th; and affordability 51st. Virginia Beach has the highest homeownership rate of all cities considered: 63.18 percent, according to data. That’s more than twice as much as Miami, which has the lowest homeownership rate of 30.53 percent. Virginia Beach also has the lowest share of residents living in poverty, 8.2 percent, compared to Detroit, which holds the highest rate at 39.4 percent.